The smart Trick of Clark Wealth Partners That Nobody is Discussing

Fascination About Clark Wealth Partners

Table of ContentsClark Wealth Partners for BeginnersHow Clark Wealth Partners can Save You Time, Stress, and Money.See This Report about Clark Wealth PartnersThe Of Clark Wealth PartnersThe Buzz on Clark Wealth Partners

This helps you in maintaining calm rather of making hoggish or fear-based choices. This psychological technique comes with experience that is why a reasonable economic advisor can constantly be of tremendous assistance.With the aid of a financial adviser to aim you in the ideal instructions, you are able to have the basis whereupon you can develop lasting financial success. For this reason, generally hiring an economic adviser is a primary move in the method towards monetary protection and self-reliance. It is constantly good to have actually someone qualified with you to lead you and include added worth to your investments, that is why you should always think about having a financial expert.

Of the record's many searchings for, maybe the most intriguing one was the revelation that the lower-income team gained from monetary guidance greater than the upscale individuals did. The ILC record showed it wasn't simply wealthier individuals that benefitted from financial advice over a years. Instead, it showed up that those defined as 'just managing' achieved a greater increase to their finances in spite of starting from a lower standard.

In the 'affluent' group, this distinction was extra moderate but still remarkable. Upscale people who listened had 24,266 more after 10 years than their non-advised counterparts, an 11% boost. The report also gauged the effect on non-pension properties such as financial savings and investments. Again, the advantages for those 'just managing' were proportionally higher: a 35% increase to non-pension wide range contrasted to non-advised individuals.

The 9-Second Trick For Clark Wealth Partners

It contrasted those that had taken suggestions just when (at the begin of the years) with those that had also gotten suggestions 2 years before the end of the years. Those who had actually taken extra guidance were located to be, generally, 61% much better off generally. However, this figure needs to be treated with caution, as the record does not represent the initial riches degrees of these two groups.

On this basis, savers might expect to pay in between 1,700 and 2,500 for one-off independent recommendations on their financial placement. As a guideline of thumb, the more properties you have, the higher the cost will be. The consultant's charge would likely consist of an option of the very best products for your circumstances and objectives, in addition to all the execution needed.

The ILC study takes into consideration just a years and determines the worth of economic advice over that period. In method, the timescale of suggestions is a lot longer than this as savers construct up their pension pots throughout their professions, which could be 40 years and even longer. Discover out if you're saving enough for retired life with our pension calculator below.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

66% is thought about comfortable revenue degree for retirement. Try adjusting the values below to get to the target. Comfy retired life 0% Intend to enhance your pension plan? We'll discover a pension plan expert flawlessly matched to your demands. Starting is simple, quick and complimentary. In the direction of completion of their professions, these savers will be looking to safeguard their revenue over their retired life, which could be another 20 to three decades.

Discover even more about the many methods in which financial advice can help you. The ILC study shows that spending in good economic guidance can verify it deserves over the lengthy term. Also a little charge can result in much bigger gains gradually, especially for those with less cash at their disposal.

Because the economy changes and advances daily, having a sane buddy by your side can be a decisive variable for successful financial investment choices. Every individual has his or her own monetary circumstance and obstacles to deal with. A monetary organizer meticulously checks your present possessions and obligations, and future objectives to establish an individualised individual financial plan.

How Clark Wealth Partners can Save You Time, Stress, and Money.

This aids you in maintaining tranquil instead of making greedy or fear-based decisions. This emotional discipline comes with experience that is why a practical monetary consultant can constantly be of tremendous assistance.

With the aid of an economic advisor to point you in the right instructions, you are able to have the basis upon which you can develop resilient economic success - civilian retirement planning. https://efdir.com/Clark-Wealth-Partners_365753.html. Usually employing a financial adviser is a preparatory step in the way in the direction of financial protection and self-reliance. It is constantly wonderful to have somebody qualified with you to lead you and include additional value to your financial investments, that is why you should always consider having an economic expert

Getting The Clark Wealth Partners To Work

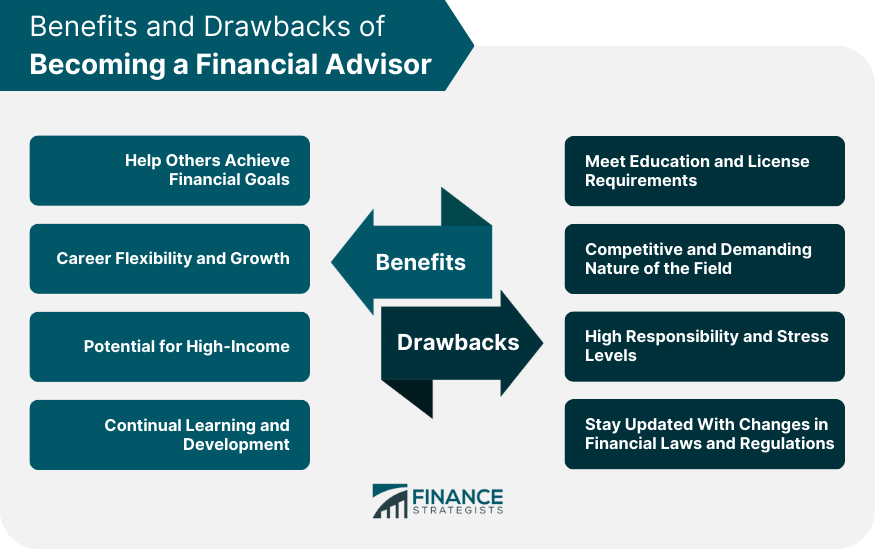

This short article explains the advantages and disadvantages of becoming a monetary advisor - https://gravatar.com/clarkwealthpt, as well as a suggested course of activity if you choose to seek this profession. One of the most crucial indicate remember is that success in the financial services sector implies. There are a number of ways to properly market on your own (see listed below); the trick is perseverance and determination.